A year ago I recommended investors adopt a defensive posture in regards to the stock market. Stocks were able to move higher, before chopping sideways and then selling off in this current period of volatility. Significant price swings have become commonplace and stocks have so far in 2015 delivered negative returns. My recommendation to underweight stocks was not based on predicting an imminent bear market. Instead, it was a declaration that the risks versus rewards of owning stocks were too negative to justify even a neutral weighting, and the potential for a bear market too high. For a long time, I had been writing about the risks to this current bull market, but that was the first time I recommended the more conservative, defensive posture that I continue to advocate. The reasons for that call are worth revisiting, particularly my worries about China, as they now seem especially pertinent.

Investments

Worth Reading 9.8.15

Worth Reading 8.19.15

A trio of articles pointing out problems with Federal Reserve monetary policy:

St. Louis Fed Official: No Evidence QE Boosted the Economy

U.S. Lacks Ammo for Next Financial Crisis

If the Fed is Always Wrong How Can Its Policies Ever Be Right

The Next Big Thing is the Continuum

I.C. Angles Investment Post…

What is the next big thing in the digital technology revolution? Nothing. Zero. Zilch. Nowadays kids are whipping out computers from their pockets to digitize their latest meal and share what they ate on social media networks that span the globe. It’s self-evident we’ve converted and disseminated everything we even marginally care about into the 0s and 1s of the virtual world displayed on our computers. But if mobile computing and social media mark the end of the digital revolution, what will come next for users who are largely interacting with the digital information on their displays? Is it the Internet of Everything, wearables, the smart car, smart home, smart city, 3D printing, quantum computing, robotics, the cloud, Big Data, the maker movement, drones?

Read the rest of this post at EE Times.

Greek & Chinese Known Unknowns

I.C. Angles Investment Post…

“There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don’t know. But there are also unknown unknowns. There are things we don’t know we don’t know.” — Donald Rumsfeld, Former U.S. Secretary of Defense

Greece and China have both been in business headlines in June, reminding me of Donald Rumsefeld’s famous quote about known unknowns. It is widely known that Greece may exit the Euro, and as I write this column news has broken that Greek banks will be closed on Monday and capital controls imposed in the country in response to the deepening crisis. It is also known that in response to a slowing economy and recent two week selloff in its stock market, the Chinese government has cut its benchmark lending rate to a record low and is pursuing increasingly accommodative policies. Those are the known knowns.

Buyback Bonanza

I.C. Angles Investment Post

Why is the U.S. stock market still edging higher? Economic news and corporate earnings have largely been disappointing. Financial journalists who not too long ago proclaimed that falling oil prices would be a boon to the economy, as consumers had more money in their pockets to spend, have lately been writing articles about how the first quarter was disappointing, due to a strong U.S. dollar and those very same falling oil prices. As for me I still stick by my initial analysis that falling oil prices are a negative, due to their deleterious impact on a U.S. energy sector that was previously caring more than it’s weight, when it comes to creating good paying jobs and generating capex spending. What is more, many investors in 2015 reduced their exposure to U.S. stocks. So, how could stocks possibly seesaw their way, admittedly with more volatility and less upward price momentum, to new record highs? The answer appears to be a corporate buyback bonanza.

Worth Reading 4.16.15

If you are concerned, as I am, about the possibility that the stock market may be in a topping phase, the following recent articles are worth a read:

“The Big Four Economic Indicators: Industrial Production”

“Surge in European Equity Valuations”

“Disaster is Inevitable When the Two Decade-Old Stock Bubble Bursts”

“We Traveled Across China and Returned Terrified for the Economy”

Stock Market Tug of War

I.C. Angles Investment Post…

So far in 2015, the bulls and bears have been in a tug of war on the direction of the stock market. The first quarter has fluctuated between the S&P 500 posting new record highs and turning in a negative return for the year. Both sides have compelling arguments for stocks heading lower or higher in the near term. The bears argue stocks should head lower, because most measures of economic performance have come in below expectations. The economy rather than taking off, as was widely anticipated, is ebbing closer to stall speed. Obviously a recession would be a huge negative for stocks. On the other hand, the bulls have several reasons for why disappointing economic data should not stand in the way of stocks making new highs.

Worth Reading 2.18.15

Published today, this is a nice complement, to my post from yesterday “Looking Toppy” of four charts pointing to an economy and stock market that may be topping…

“Seven Charts that Suggest the Rising Stock Market May be Wrong”

Looking Toppy

I.C. Angles Investment Post

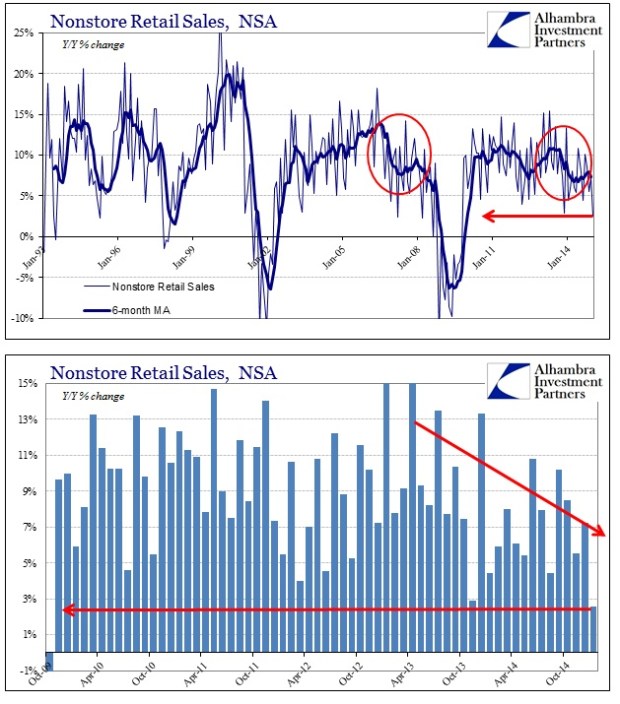

Following are four charts that point to an economy and stock market that may be topping.

Sales growth reminiscent of last recession….

Courtesy of Alhambra Investment Partners

“Aggregate Demands Shocking Lack of Demand”